Mortgage rates just took a major drop from about 7% to 6.49%, likely saving home buyers hundreds of dollars on monthly payments. The drop came after bad employment news.

Weaker employment, when combined with increasing inflation that we are seeing, creates a worrisome economic situation that may lead to very-difficult-to-remedy stagflation, economists warn.

On the positive front, Housing Wire’s lead analyst Logan Mogashami said lower mortgage rates are already and noticeably impacting increased housing demand.

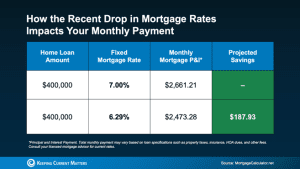

This diagram from Keeping Current Matters shows what the recent mortgage decline would save homeowners who take out a $400,000 mortgage, $188 monthly and $2,255 annually.

Of course, no one can anticipate the direction of rates over a longer term. However, many analysts anticipate that the recent drop will bring more home buyers out shopping, and provide more incentive for homeowners, who had been postponing their next move, to list their properties.

Homebuyer mortgage applications jumped 23% year-over-year as 30-year fixed-rate mortgages dropped to the lowest level since October 2024, noted the Mortgage Bankers Association (MBA).

“Mortgage rates declined for the second consecutive week…on data indicating that the labor market is weakening,” said MBA Deputy Chief Economist Joel Kan. The 30-year fixed rate decreased to 6.49 percent – near the inflection point that will fuel a large burst in buyers shopping for homes, according to Housing Wire’s Logan Mogashami.

“Mortgage rates declined for the second consecutive week…on data indicating that the labor market is weakening,” said MBA Deputy Chief Economist Joel Kan. The 30-year fixed rate decreased to 6.49 percent – near the inflection point that will fuel a large burst in buyers shopping for homes, according to Housing Wire’s Logan Mogashami.